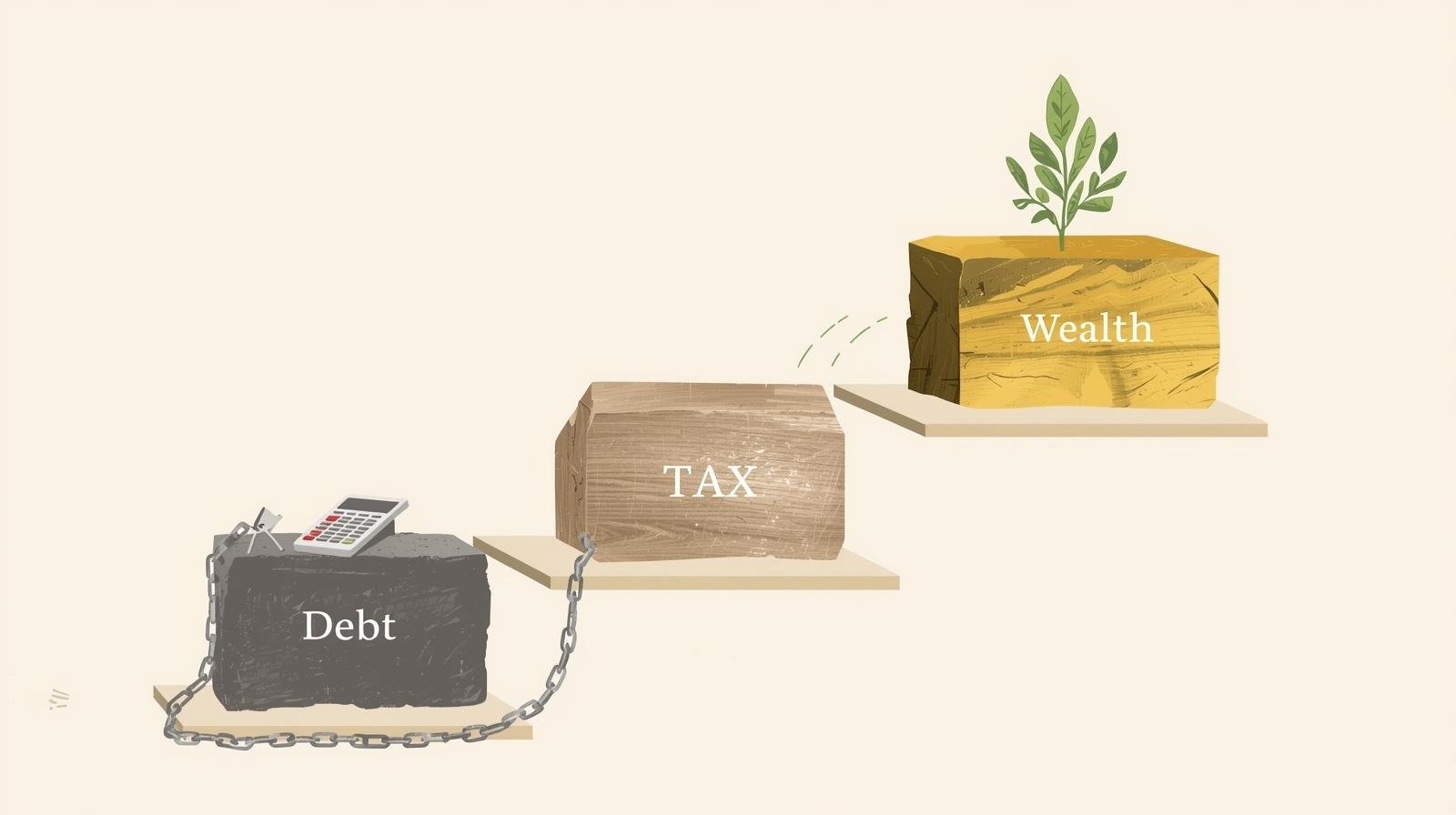

A simple roadmap to overcome debt, optimize taxes, and build wealth

Most people I talk to about money share the same story. They work hard, but at the end of the month, they feel like they’re just treading water. Debt payments eat into cash flow, taxes take a bigger slice than expected, and wealth building feels like a dream reserved for “someday.”

I believe financial freedom doesn’t happen by accident—it happens by design. That’s why I created the KC 3-Stage Money System. It’s a simple framework to help you move from financial survival to financial stability, and ultimately, to lasting wealth.

Let’s walk through each stage.

Stage 1: Overcome Debt

Debt is the first obstacle to freedom. Why? Because interest works against you. Every dollar going to service debt is a dollar that can’t be saved, invested, or used to grow your future.

How to tackle it:

- Prioritize high-interest debt. Credit cards and payday loans are wealth killers. Focus on clearing them first.

- Choose your strategy. The snowball method (start small for quick wins) or the avalanche method (attack highest interest first) both work. What matters is commitment.

- Shift your mindset. Debt isn’t “normal.” You don’t have to live chained to monthly payments.

✅ Quick win: Review your recurring expenses today—subscriptions, unused memberships, or unnecessary add-ons. Cancel them and redirect the savings to extra debt payments.

Stage 2: Optimize Tax

Most Canadians don’t realize it, but taxes are their single biggest lifetime expense. Yet many overpay simply because they don’t plan.

Tax planning isn’t about loopholes or tricks—it’s about stewardship. The government gives you tools; your job is to use them wisely.

How to optimize:

- Review past filings. Did you miss deductions or credits?

- Maximize registered accounts: RRSPs, TFSAs, and RESPs if you have kids.

- Keep good records. Small business owners, freelancers, or anyone with side income should track every deductible expense.

When you optimize taxes, you’re not just saving money—you’re protecting wealth that belongs in your household, not just in Ottawa.

Stage 3: Build Wealth

Once debt is cleared and taxes are optimized, the door opens for wealth building. This is where your money finally works for you instead of against you.

How to build sustainably:

- Start with an emergency fund (3–6 months of expenses).

- Invest consistently in TFSAs and RRSPs.

- Think long term: build assets (real estate, businesses, investments) that can generate income and outlast you.

Wealth isn’t about luck or a high income—it’s about building systems that compound quietly over time.

The Forward Framework: Pattern Recognition → Utilization → Creation

Here’s how to take this system further:

- Pattern Recognition – Take an honest look at your financial patterns. Where is money leaking? Where are you consistent? Awareness is the first step.

- Utilization – Maximize what you already have: government programs, employer benefits, tax shelters, and even your current income. Stewardship means using resources fully.

- Creation – Once disciplined, move beyond managing money to creating value—whether through side businesses, investments, or building generational wealth.

This progression isn’t just financial—it’s biblical stewardship in action. You’re moving from being a consumer of money to a creator of opportunities.

Your Next Step

Here’s my challenge for you: Identify which stage you’re in today. Are you fighting debt, working to optimize taxes, or ready to build wealth? Wherever you are, the key is to keep moving forward.

The KC 3-Stage Money System gives you a roadmap. The forward framework gives you momentum. And the decision to act—that’s in your hands.

👉 If you’re ready to move from surviving to thriving, let’s talk. Book a free consultation and start your KC Money System journey today.