Why Budgeting for Immigrants Looks Different

Let’s be real — budgeting for immigrants isn’t the same as what you see in most finance videos or blogs. Most experts talk about budgets like they’re one-size-fits-all, giving the same old “50-30-20” formula.

But if you’re an immigrant, you already know that life doesn’t fit into neat percentages. Many of us have family back home depending on us — parents, siblings, or relatives who may have sacrificed for us to build a better life abroad. Sometimes, they even sold land or property to help you get here.

That’s why your budget has to reflect both your life now and the roots that made it possible.

What Is a Budget – Really?

A budget isn’t about restriction. It’s about direction.

“A budget is telling your money where to go, instead of wondering where it went.”

Budgeting for immigrants is about taking control — knowing exactly how much goes toward rent, savings, investments, family support, and a little joy for yourself. Because life abroad can be tough, and you deserve balance, not burnout.

Psychology of Money – Habits That Shape Your Budget

One of the best books on personal finance, The Psychology of Money by Morgan Housel, reminds us that financial success is more about behavior than intelligence.

And that’s true especially when budgeting for immigrants — where your money decisions are often emotional. You’re not just budgeting numbers; you’re budgeting values, love, and long-term dreams.

So, instead of focusing only on numbers, focus on habits:

Track your spending weekly, even if it’s rough.

Automate savings so it happens without thinking.

Build routines that make good money choices easy.

Because personal finance is 20% knowledge and 80% habit.

The Coffee Myth – Spend Where It Matters

Here’s a hot take: buying a daily coffee doesn’t mean you’re bad with money.

If that cup of coffee helps you stay awake for your second job, focus in your evening class, or power through a long day while working to upskill and pivot your career — then that’s an investment in your growth.

Budget for it intentionally. Don’t feel guilty. Intentional spending is smart spending.

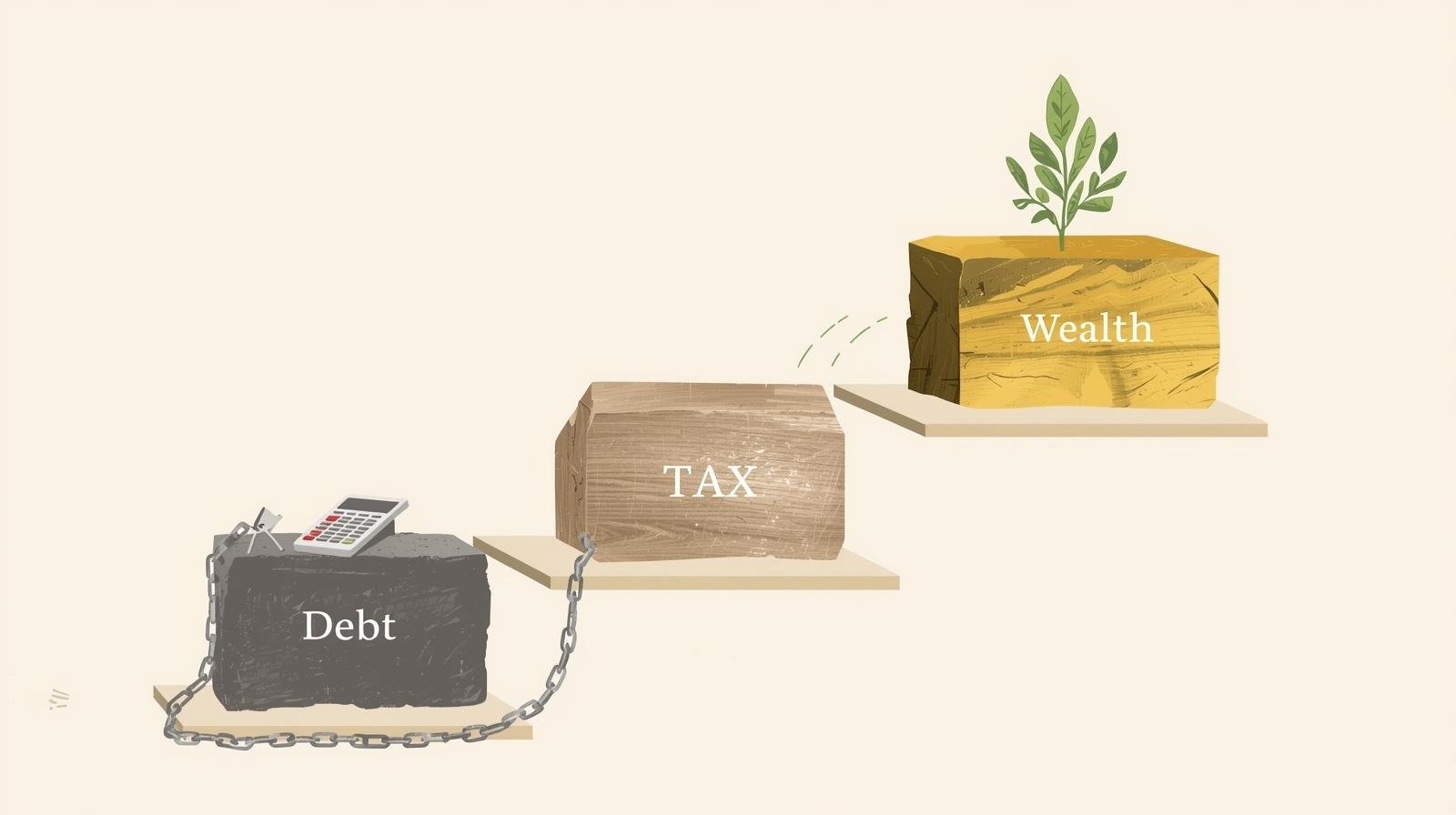

Smart Budgeting for Immigrants – Beyond the 50/30/20 Rule

Let’s ditch the cookie-cutter 50/30/20 rule (50% needs, 30% wants, 20% savings).

Instead, build your own Immigrant Budget Framework (IBF):

- 50% Survival & Stability: rent, food, transportation, bills

- 20% Family & Faith: money sent home, giving, and support

- 15% Future Growth: courses, upskilling, investments

- 10% Enjoyment: coffee, social life, small luxuries

- 5% Freedom Fund: savings for emergencies or travel

You’re not “off track” if your money story looks different. You’re simply writing a different kind of success.

Gamify Your Money – Make Saving Fun

Budgeting doesn’t have to feel boring. Turn it into a game:

- Coffee Match Rule: For every $5 you spend on coffee, save or invest another $5.

- Mirror Purchases: Buy a new phone? Buy the same value in that company’s stock.

- Brand Loyalty Challenge: Love Nike or Apple? Own a piece of them — buy their stock too.

These small “money games” help build wealth habits while keeping budgeting fun and motivating.

Final Takeaway – Build Habits, Not Just Budgets

At the end of the day, budgeting for immigrants is about progress, not perfection.

Remember:

Personal finance is 20% knowledge and 80% habit.

So start small, stay consistent, and make your money work with your values — not against them.